Fill out the CKHT 1A form disposal of real property. Submit all the forms and documents to the IRB office.

15 Isikan Lampiran 3 4 atau 5 sekiranya ingin membuat pengiraan sendiri sebagai pembelajaran cukai.

. Pastikan Borang CKHT 1A diisi dengan lengkap dan jelas. Pastikan setiap pelupus mempunyai nombor rujukan cukai pendapatan. If the seller is an individual selling the property after five years the seller or sellers lawyer will file Form CKHT 3 to apply to be exempted from the 3 retention sum.

Made in the prescribed CKHT 1A and CKHT 2A forms respectively to the Director If there is no tax payable prescribed CKHT 3 has to be submitted to the. Disebabkan korang dah memiliki rumah tersebut selama 12 tahun kadar CKHT yang dikenakan adalah sebanyak 5. CKHT 3 LEMBAGA HASIL DALAM NEGERI MALAYSIA PEMBERITAHUAN DI BAWAH SEKSYEN 136 AKTA CUKAI KEUNTUNGAN HARTA TANAH 1976 Borang ini ditetapkan di bawah seksyen 57 Akta Cukai Keuntungan Harta Tanah 1976 Saya Syarikat dengan ini memberitahu bahawa saya bersetuju untuk melupuskan suatu harta tanahsaham dalam syarikat harta tanah CKHT 3.

Ckht 1a1b ckht 3. As such the CKHT Form 3 is for now redundant. RM800000 RM500000 RM300000 Gross Gain Net Chargeable Gain.

CKHT 1A PDF. Sekiranya saya memberi keterangan yang tidak benar yang menyebabkan pemeroleh gagal menahan dan meremitkan bayaran. CKHT 3 Borang AKTA CUKAI KEUNTUNGAN HARTA TANAH 1976 LEMBAGA HASIL DALAM NEGERI MALAYSIA PEMBERITAHUAN DI BAWAH SEKSYEN 136 Borang ini ditetapkan di bawah Seksyen 57 Akta Cukai Keuntungan Harta Tanah 1976 CKHT 3 - Pin.

Malaysian Company Foreigner. Ingat cukai yang korang kena bayar adalah berdasarkan keuntungan terkena cukai bersih. Dengan ini memberitahu bahawa saya bersetuju untuk melupuskan suatu harta tanahsyer dalam syarikat harta tanah.

For exemptions fill out form CKHT 3 Notification under Section 27 RPGTA 1976 5. Along with this you have to include the sale and purchase agreement. Ckht 1a ckht 1b ckht 2a ckht 3 Since the passing of budget 2019 all properties are now subject to a.

Dear members of the bar below are the new ckht forms for yor viewing and downloading. Based on Form CKHT 1A submitted by the seller the IRB will then assess the requisite RPGT chargeable and refund the balance of the 3 retention sum if any to the seller. You may also include any other.

Setiap pelupus dikehendaki mengisi borang CKHT 1A secara berasingan dan mengemukakannya bersama. Yes this is also needed. Get your buyer to fill out form CKHT 2A the acquisition of real property.

Wait for your confirmation notice. Fill out a CKHT 1A Disposal of Real Property form. 3 10 daripada keuntungan atau rm10 000 bagi setiap transaksi yang mana lebih.

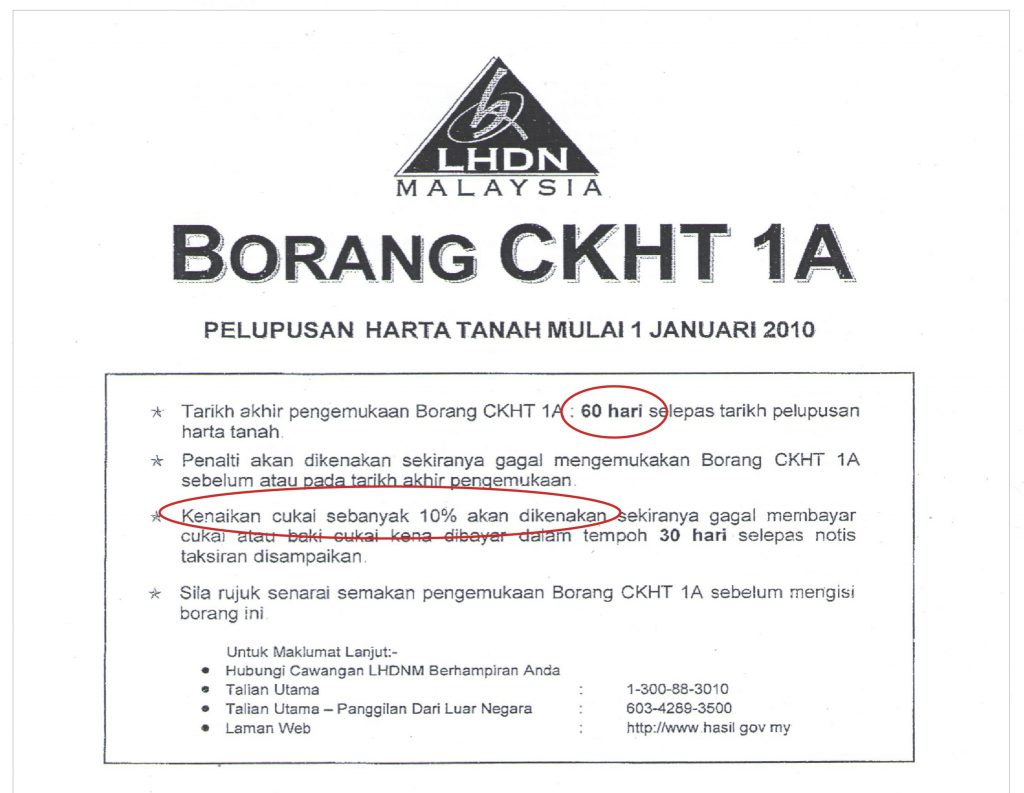

Fill out the Disposal of Real Property CKHT 1A form the Sale and Purchase Agreement SPA form and other documents supporting the deductions you plan to make from RPGT. 2 Salinan CKHT 3 perlu diberikan kepada pemeroleh untuk dikemukakan bersama-sama Borang CKHT 2A oleh pemeroleh ke LHDNM dalam tempoh 60 hari selepas tarikh pelupusan harta tanah syer dalam syarikat harta tanah. 3 order 2020 and stamp duty exemption no.

Since the passing of Budget 2019 all properties are now subject to a minimum of 5 of real property gain tax even if it is disposed after 5 years. Borang ini ditetapkan di bawah seksyen 57 Akta Cukai Keuntungan Harta Tanah 1976. The above information is intended for educational or reference purposes only as such it should not be used to inform or.

2 Salinan CKHT 3 perlu diserahkan kepada pemeroleh untuk dikemukakan bersama-sama Borang CKHT 2A oleh pemeroleh ke LHDNM dalam tempoh 60 hari selepas tarikh pelupusan harta tanah syer dalam syarikat harta tanah. CKHT Form 502 is the form for the remittance of the 3 retention sum by the purchaser to the LHDN. RM300000 RM30000 10.

Sekiranya saya memberi keterangan yang tidak benar yang menyebabkan pemeroleh gagal menahan dan meremitkan bayaran. CKHT 3 LEMBAGA HASIL DALAM NEGERI MALAYSIA PEMBERITAHUAN DI BAWAH SEKSYEN 136 AKTA CUKAI KEUNTUNGAN HARTA TANAH 1976. If you plan to apply for exemptions under the RPGT Act then make sure to fill out the Notification under Section 27 in the RPGTA 1976 CKHT 3 form.

CKHT 3 perlu dikemukakan bersama-sama Borang CKHT 1A atau CKHT 1B ke LHDNM dalam. Based on CKHT 3 please find the percentage table below-MalaysianLocal Company Non Malaysian. Before and during the selling process he was spending about RM50000 for maintaining his property lawyer fees for sales and other miscellaneous costs which allow for exemption.

Now at 2019 he sold off the property for RM800000. Cukai yang kena dibayar Keuntungan Cukai Bersih X Kadar CKHT berdasarkan tempoh pegangan RM17100 x 5. Latest 2019 RPGT Rates in Malaysia.

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Ckht 1a Pin1 2021 2022 Versions A Kod Aset B Cawangan Yang Mengendalikan Fail Pelupus Studocu

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Cara Kira Cukai Keuntungan Harta Tanah Ckht Bagi Tahun 2019

Dikemaskini 2020 Cukai Keuntungan Harta Tanah Ckht Atau Rpgt

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

All About Rpgt Real Property Gain Tax 2019 My Awesome Property

Tax Return Pictures Download Free Images On Unsplash

Ckht 3 1 Good Ckht 3 Lembaga Hasil Dalam Negeri Malaysia Pemberitahuan Di Bawah Seksyen 13 6 Studocu

Cara Kira Cukai Keuntungan Harta Tanah Ckht Bagi Tahun 2019

Cukai Keuntungan Harta Tanah Portal Jabatan Penilaian Dan Perkhidmatan Harta

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

- tempat menarik di ayer keroh

- contoh ayat perkataan jambu merah

- cara pemakaian mask bioaqua

- gambar kartun hitam putih kulit kayu

- cara panjangkan rambut dengan cepat tradisional

- perbarisan sk rumah merah

- borang guru kafa

- mawar putih untuk mama karaoke

- merah hati dalam bahasa inggris

- min hyo rin instagram

- gambar rambut hitam putih

- bank islam skim kereta graduan

- contoh hiasan bilik tidur pengantin simple

- undefined

- ckht 3 2019

- resepi almond london mudah

- coverset 125zr hitam skala

- cara check water pump kereta

- pejabat tanah galian perak

- peranan pusat sumber sekolah